What is Generational Marketing to Insurance Agencies?

Generational marketing is crucial for insurance agencies to effectively engage clients across different age groups. Each generation has distinct preferences, communication styles, and values. Tailoring your approach ensures you deliver the right message through the right channels, building stronger relationships and driving growth.

Too Long to read? Here s a Quick Infographic

What Current Insurance Agencies Are Doing Wrong

1. Failing to Tailor Messaging for Each Generation

Many insurance agencies mistakenly use a one-size-fits-all approach to marketing, sending out the same generic messages across all channels, regardless of the audience's age group. This approach fails to resonate with the distinct preferences, values, and concerns of different generations.

2. Weak Digital Presence for Younger Generations

A significant number of insurance agencies still lack a robust digital presence, which is a critical misstep when trying to attract and retain younger generations like Millennials and Generation Z. These groups are highly dependent on digital platforms for information, decision-making, and purchasing.

3. Over-Reliance on Traditional Methods

Many insurance agencies continue to depend too heavily on traditional marketing methods, such as cold calling, direct mail, or print ads, without integrating these efforts with digital strategies. While these methods may still hold some value, especially for older generations, they are less effective when not balanced with a digital approach.

4. Ignoring Social Proof and Peer Influence

Younger generations, particularly Millennials and Gen Z, place significant trust in peer reviews, social proof, and online testimonials. Unfortunately, many insurance agencies underestimate the power of social proof in their marketing strategies.

Many insurance agencies mistakenly use a one-size-fits-all approach to marketing, sending out the same generic messages across all channels, regardless of the audience's age group. This approach fails to resonate with the distinct preferences, values, and concerns of different generations.

2. Weak Digital Presence for Younger Generations

A significant number of insurance agencies still lack a robust digital presence, which is a critical misstep when trying to attract and retain younger generations like Millennials and Generation Z. These groups are highly dependent on digital platforms for information, decision-making, and purchasing.

3. Over-Reliance on Traditional Methods

Many insurance agencies continue to depend too heavily on traditional marketing methods, such as cold calling, direct mail, or print ads, without integrating these efforts with digital strategies. While these methods may still hold some value, especially for older generations, they are less effective when not balanced with a digital approach.

4. Ignoring Social Proof and Peer Influence

Younger generations, particularly Millennials and Gen Z, place significant trust in peer reviews, social proof, and online testimonials. Unfortunately, many insurance agencies underestimate the power of social proof in their marketing strategies.

Marketing and Selling Strategies to Different Generations

1. Silent Generation (Born 1928-1945)

Marketing Strategy:

1. Leverage Traditional Media for Lead Generation:

2.. Personalized Direct Mail Campaigns:

Sales Strategy:

1. Host In-Person Workshops:

1. Leverage Traditional Media for Lead Generation:

- Use local newspapers, radio stations, and community bulletins to advertise. This generation still trusts traditional media. For example, run an ad campaign in local papers emphasizing the agency’s history and trustworthiness.

- Partner with community centers or organizations where they socialize. Sponsor events such as senior community luncheons or health fairs, which can lead to direct engagement.

2.. Personalized Direct Mail Campaigns:

- Design direct mail with a personal touch. Use tools like Sendoso or PostcardMania to send customized postcards or newsletters detailing specific policy benefits.

- Include a clear call-to-action (CTA) for a phone call or in-office consultation, offering a free policy review or consultation.

Sales Strategy:

1. Host In-Person Workshops:

- Organize educational workshops at local community centers, churches, or libraries on topics like "Understanding Medicare Supplements" or "Protecting Your Assets.

- Use these sessions to collect contact information for follow-ups. Tools like Eventbrite can help manage registrations and attendance.

- Offer personalized, in-home consultations. Equip agents with tablets or brochures to present information clearly and build trust. Ensure that the agent follows up via phone after each visit.

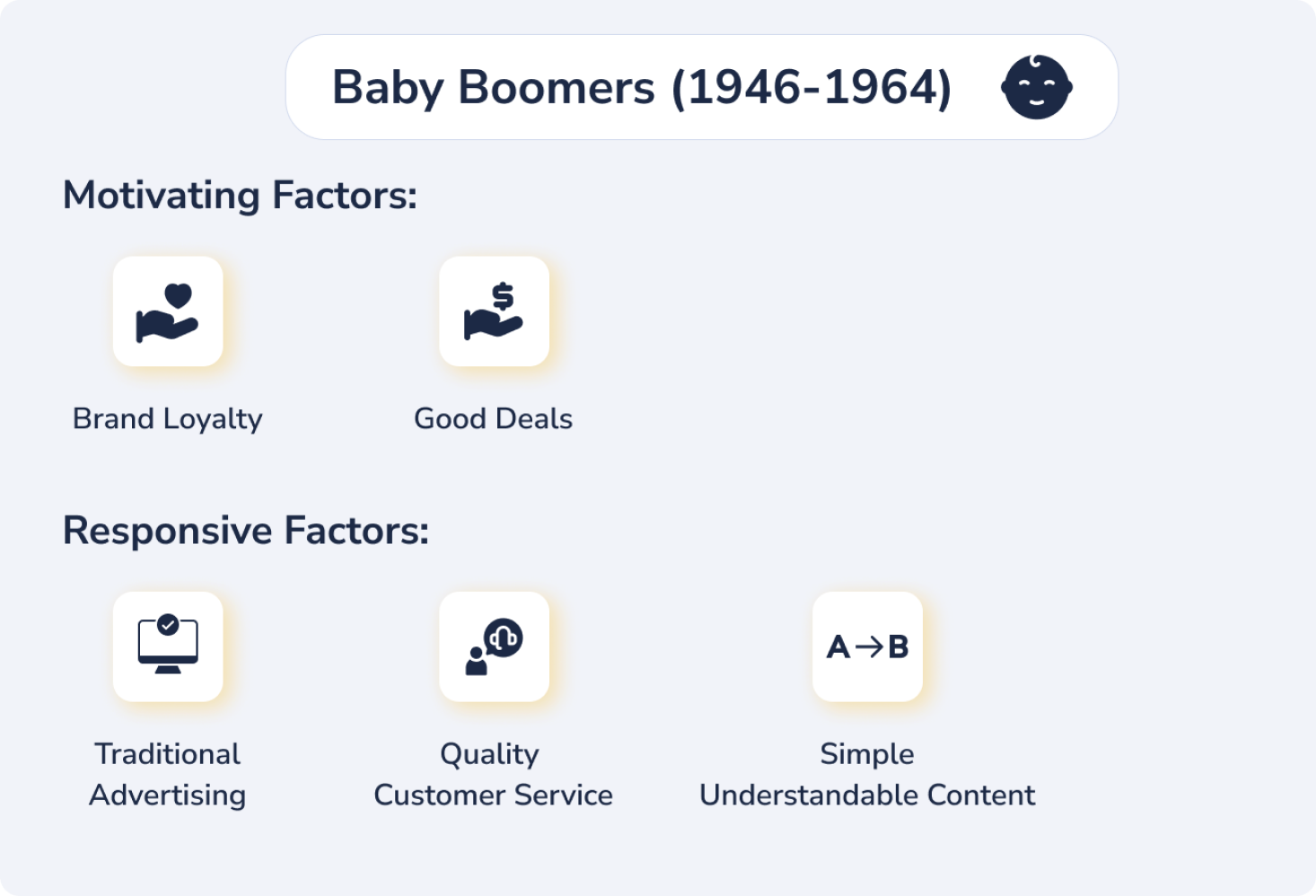

2. Baby Boomers (Born 1946-1964)

Marketing Strategy:

1. Combine Digital and Traditional Channels:

2. Target Local Community Platforms and Events:

3. Utilize Educational Content:

Sales Strategy:

1. Offer Webinars on Financial Planning:

2. In Depth Phone Consultations:

1. Combine Digital and Traditional Channels:

- Create a multi-channel approach using both email and direct mail. Use Constant Contact or Mailchimp for email newsletters featuring articles on retirement planning, long-term care insurance, and estate planning.

- Pair this with direct mail pieces offering a "free retirement insurance review" or invitations to local seminars.

2. Target Local Community Platforms and Events:

- Sponsor local events, such as golf tournaments or charity runs, to gain visibility. Use platforms like Nextdoor to target local neighborhoods where Baby Boomers reside and promote events or services+

3. Utilize Educational Content:

- Create an “Insurance Guide for Retirees” eBook or whitepaper available for download on your website. Use Lead Magnets to capture emails. Promote this content through Facebook ads targeted at users aged 55+.

Sales Strategy:

1. Offer Webinars on Financial Planning:

- Host webinars on topics like “How to Protect Your Retirement Savings with Insurance.” Tools like Zoom or WebinarJam can help host and promote these webinars. Follow up with personalized emails offering one-on-one consultations.

2. In Depth Phone Consultations:

- Schedule phone consultations after initial contact through webinars or local events. Train agents to be empathetic, patient, and well-prepared to discuss retirement-focused insurance products.

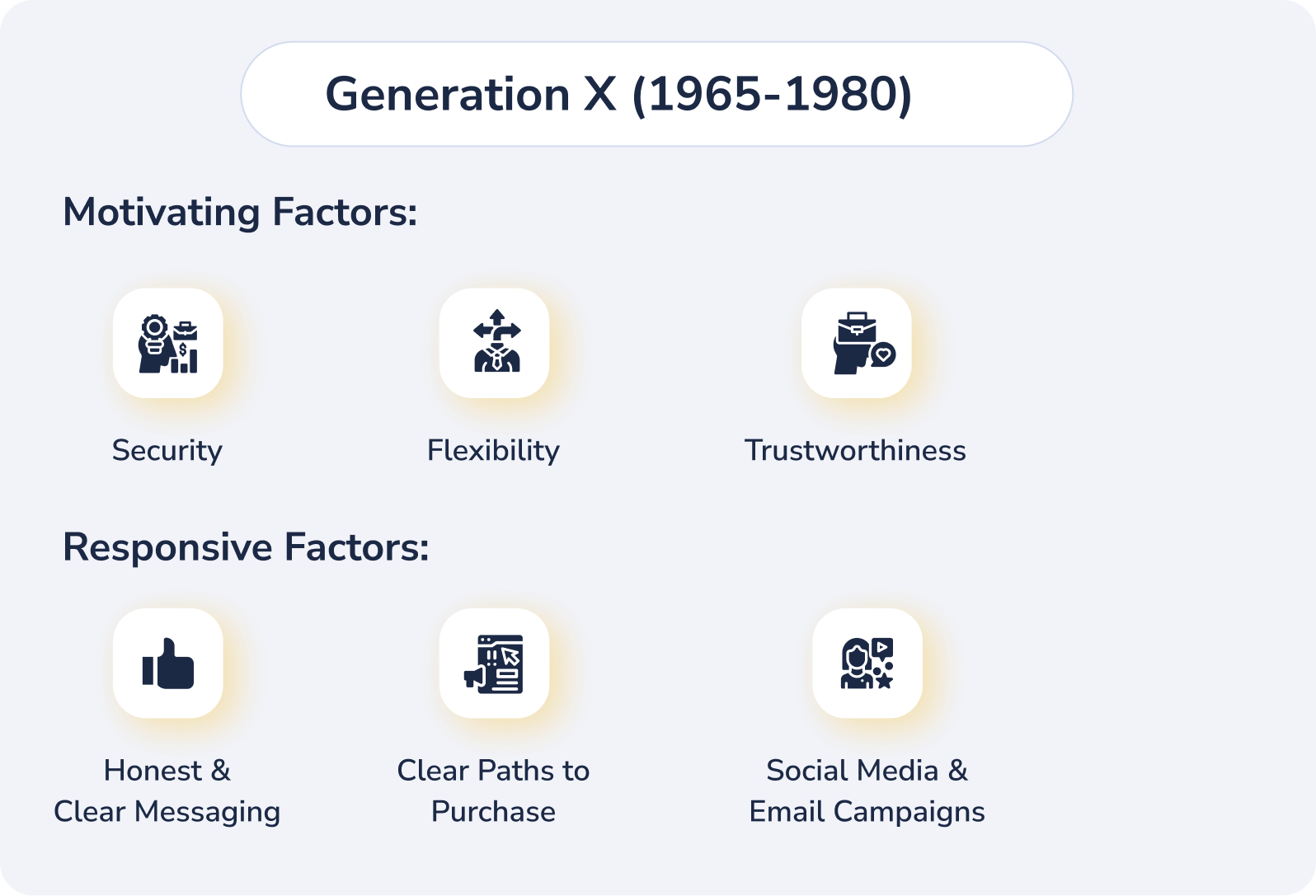

3. Generation X (Born 1965-1980)

Marketing Strategy:

1. Leverage Social Media and Professional Networks:

2. Content Marketing Through Blogs and Podcasts:

3. Email Campaigns Focused on Convenience and Flexibility:

Sales Strategy:

1. Virtual Consultations:

2. Leverage Customer Testimonials and Case Studies:

1. Leverage Social Media and Professional Networks:

- Focus on platforms like LinkedIn for commercial leads. Use targeted ads or sponsored content focusing on topics like “Business Insurance for Small Enterprises” or “Protecting Your Family’s Financial Future".

- Run lead-generation campaigns on Facebook using custom audience targeting for users aged 40-55 interested in financial security and life insurance.

2. Content Marketing Through Blogs and Podcasts:

- Create a blog series or podcast episodes on topics like “Top Insurance Mistakes to Avoid in Your 40s” or “Smart Insurance Choices for Growing Families.” Use WordPress for blogging and Anchor for podcasts.

- Optimize the content for SEO to capture organic traffic. Include lead forms to capture contact information in exchange for a newsletter or special report.

3. Email Campaigns Focused on Convenience and Flexibility:

- Use segmented email campaigns via HubSpot or ActiveCampaign to send tailored content, such as bundle offers or policy updates that highlight flexibility, convenience, and comprehensive coverage.

Sales Strategy:

1. Virtual Consultations:

- Offer video consultations using Calendly for easy appointment scheduling integrated with Zoom. Make it convenient for Gen X to discuss their options from the comfort of their home or office.

2. Leverage Customer Testimonials and Case Studies:

- Use real-life success stories or testimonials on social media and your website. Create a “Client Success” page featuring Gen X clients who have benefited from your services.

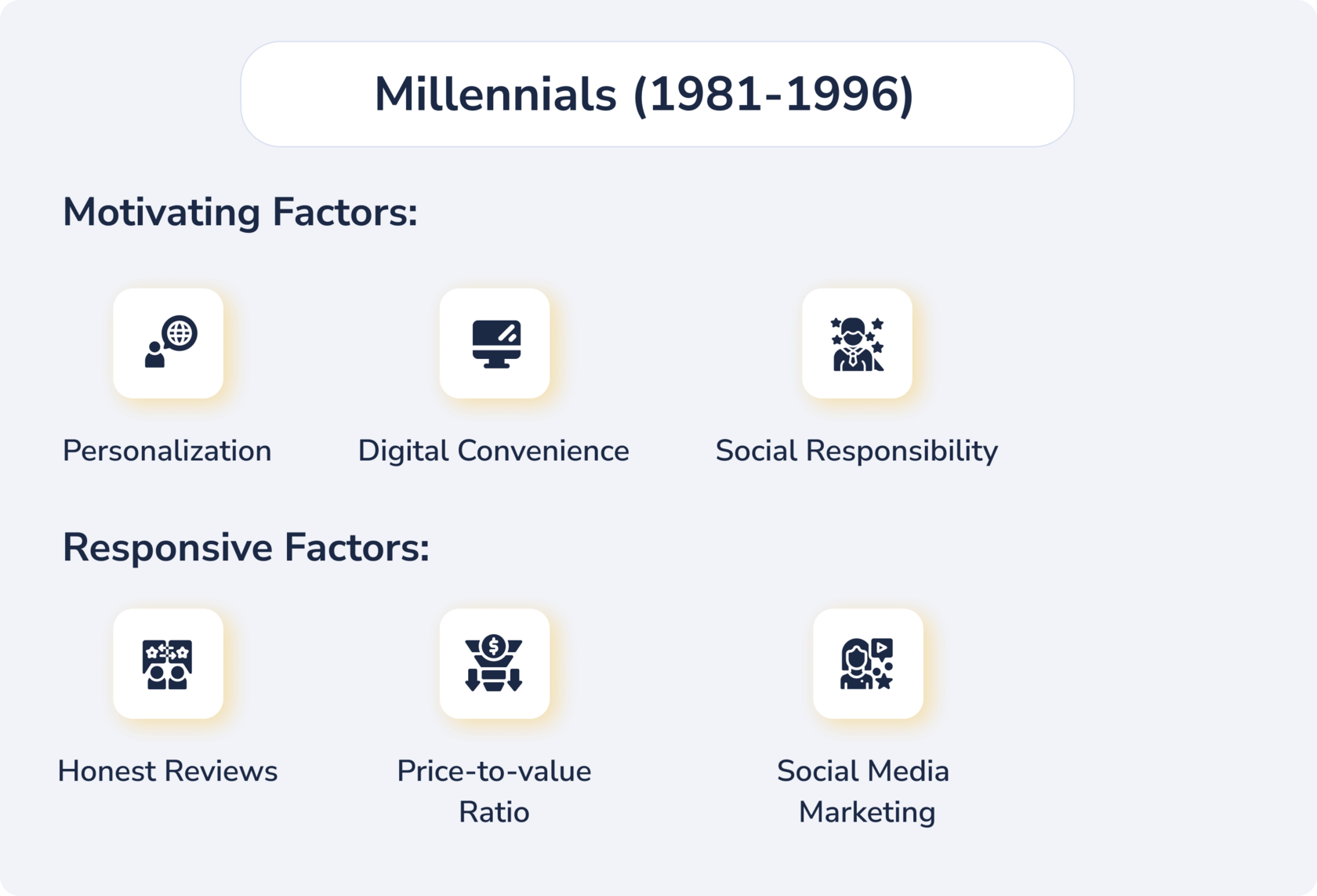

4. Millennials (Born 1981-1996)

Marketing Strategy:

1. Prioritize Social Media and Influencer Marketing:

2. Use Digital Lead Magnets:

3. Targeted Email Drip Campaigns:

Sales Strategy:

1. Offer Digital Onboarding and Instant Quotes:

2. Interactive Webinars and Live Q&A Sessions:

1. Prioritize Social Media and Influencer Marketing:

- Leverage platforms like Instagram and TikTok to create short, engaging videos about the benefits of insurance. Partner with local influencers who can speak about financial planning and security.

- Use tools like Hootsuite for managing multi-platform campaigns and analyzing engagement.

2. Use Digital Lead Magnets:

- Create a quiz or calculator, such as “Find the Right Insurance Plan for You,” using tools like Outgrow or Typeform. This generates leads by offering personalized recommendations in exchange for contact details.

- Develop downloadable resources like an “Insurance Starter Guide for Millennials” available on your website, with targeted ads driving traffic.

3. Targeted Email Drip Campaigns:

- Run email drip campaigns with ConvertKit or Drip to nurture leads over time. Focus on key messages like affordability, ease of digital management, and customizable plans.

Sales Strategy:

1. Offer Digital Onboarding and Instant Quotes:

- Provide instant online quotes through tools like QuoteWizard or your agency’s website, making it easy for Millennials to get the information they need quickly.

- Simplify the onboarding process with digital forms and e-signatures, using tools like DocuSign.

2. Interactive Webinars and Live Q&A Sessions:

- Host interactive webinars on topics like “Understanding Life Insurance in Your 30s” with live Q&A sessions. Use tools like YouTube Live or Instagram Live to reach this audience in real time.

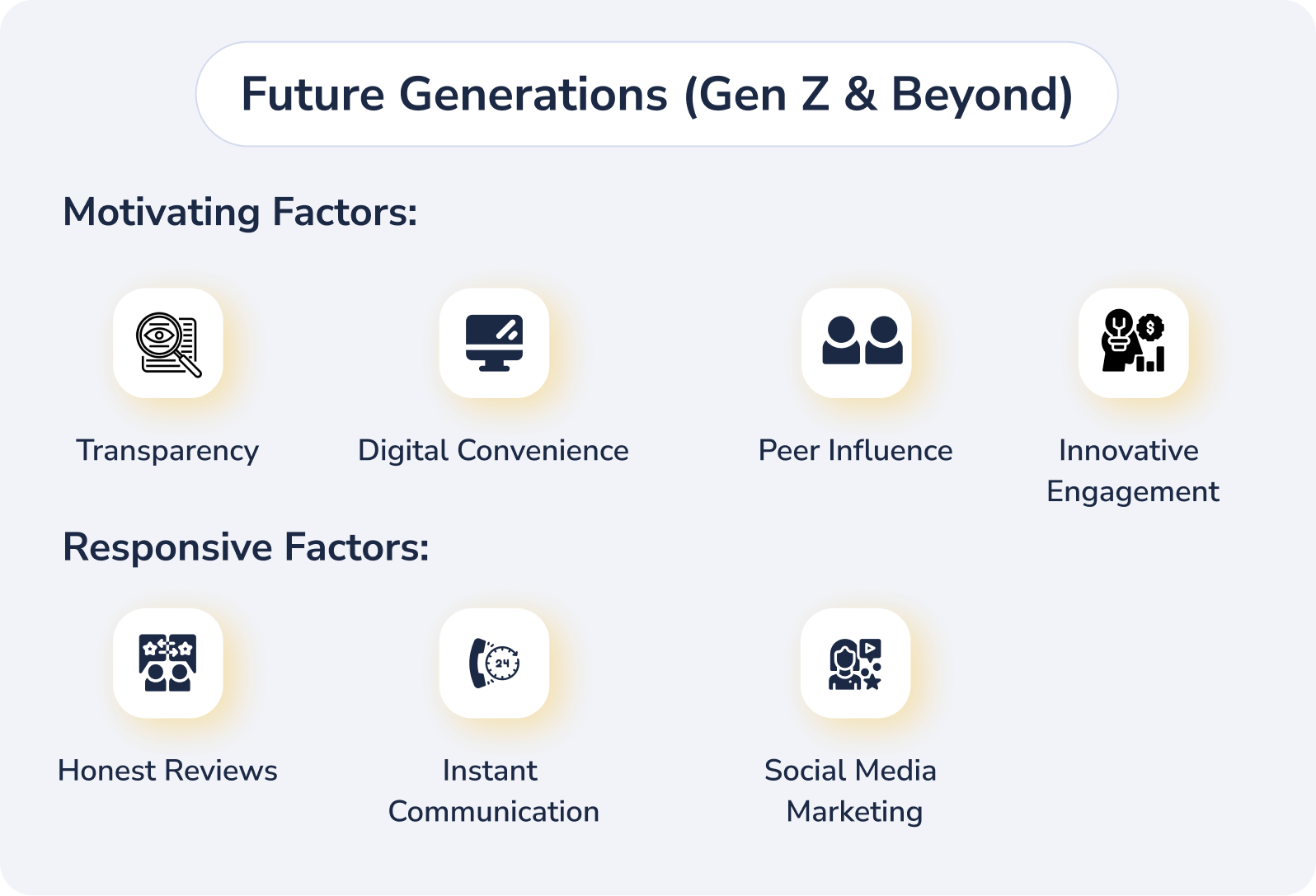

5. Generation Z (Born 1997-2012) and Beyond

Marketing Strategy:

1. Engage Through Emerging Social Media Platforms:

2. Utilize Gamification:

3. Leverage User-Generated Content:

Sales Strategy:

1. Instant Chat and AI-driven Assistance:

2. Mobile-First Approach:

3. Leverage Virtual Reality (VR) Experiences:

1. Engage Through Emerging Social Media Platforms:

- Focus on TikTok, Snapchat, and Instagram Reels to create short, engaging content on insurance basics, FAQs, or quick tips. Use trending audio and hashtags to increase visibility.

- Run interactive stories, polls, and quizzes on social media to engage this audience actively.

2. Utilize Gamification:

- Develop a gamified experience, such as an app that teaches insurance basics through challenges or quizzes. Use platforms like Kahoot! or build a custom app to keep them engaged and generate leads.

3. Leverage User-Generated Content:

- Encourage clients to share their experiences with your agency on social media. Create a branded hashtag and offer incentives like gift cards for the best stories or testimonials.

Sales Strategy:

1. Instant Chat and AI-driven Assistance:

- Implement AI chatbots on your website, using tools like Drift or Intercom, to provide instant answers and guide potential clients through the initial stages of the sales process.

2. Mobile-First Approach:

- Ensure that all content, from websites to emails, is mobile-optimized. Use tools like Google AMP to create fast-loading pages. Focus on providing quick access to quotes, policy details, and purchase options directly from a mobile device.

3. Leverage Virtual Reality (VR) Experiences:

- Create VR walkthroughs or explainer videos that showcase different insurance scenarios, helping Gen Z understand complex policies in an immersive way. Platforms like Matterport or VRdirect can facilitate this.

Need more information about online visibility?

By understanding and addressing these common mistakes, insurance agencies can transform their approach to marketing and sales. It s clear that a one-size-fits-all strategy no longer works in today s diverse marketplace. Adapting to the unique needs of each generation by tailoring messaging, strengthening digital presence, integrating traditional and modern methods, leveraging social proof, and personalizing offers provides a powerful opportunity for agencies to engage more deeply with clients.

Implementing these targeted actions will not only help capture more leads but also foster lasting relationships built on trust and relevance. Agencies that proactively evolve their strategies to connect with different generations will be better positioned to thrive in a rapidly changing landscape, ensuring growth, customer satisfaction, and loyalty for years to come.

Implementing these targeted actions will not only help capture more leads but also foster lasting relationships built on trust and relevance. Agencies that proactively evolve their strategies to connect with different generations will be better positioned to thrive in a rapidly changing landscape, ensuring growth, customer satisfaction, and loyalty for years to come.