Understanding Agent Productivity

Increasing agent productivity means enabling them to focus on high-value activities like prospecting, sales, and client relationship building rather than being swamped with administrative tasks. Productivity improvements can be quantified by setting and tracking specific goals, such as achieving $1M in gross written premium per month per agent.

Lack of Productivity:

Lack of Productivity:

- Agents often lack the time, capacity, or tools/technology to optimize operations, limiting their ability to increase sales and build relationships.

The Importance of Improving Agent Productivity

Agents often lack the time, capacity, or tools/technology to optimize operations, limiting their ability to increase sales and build relationships. Imagine the impact on your agency if you could improve your agents' productivity by just 20%.

This enhancement would not only boost your revenue but also significantly increase customer satisfaction.

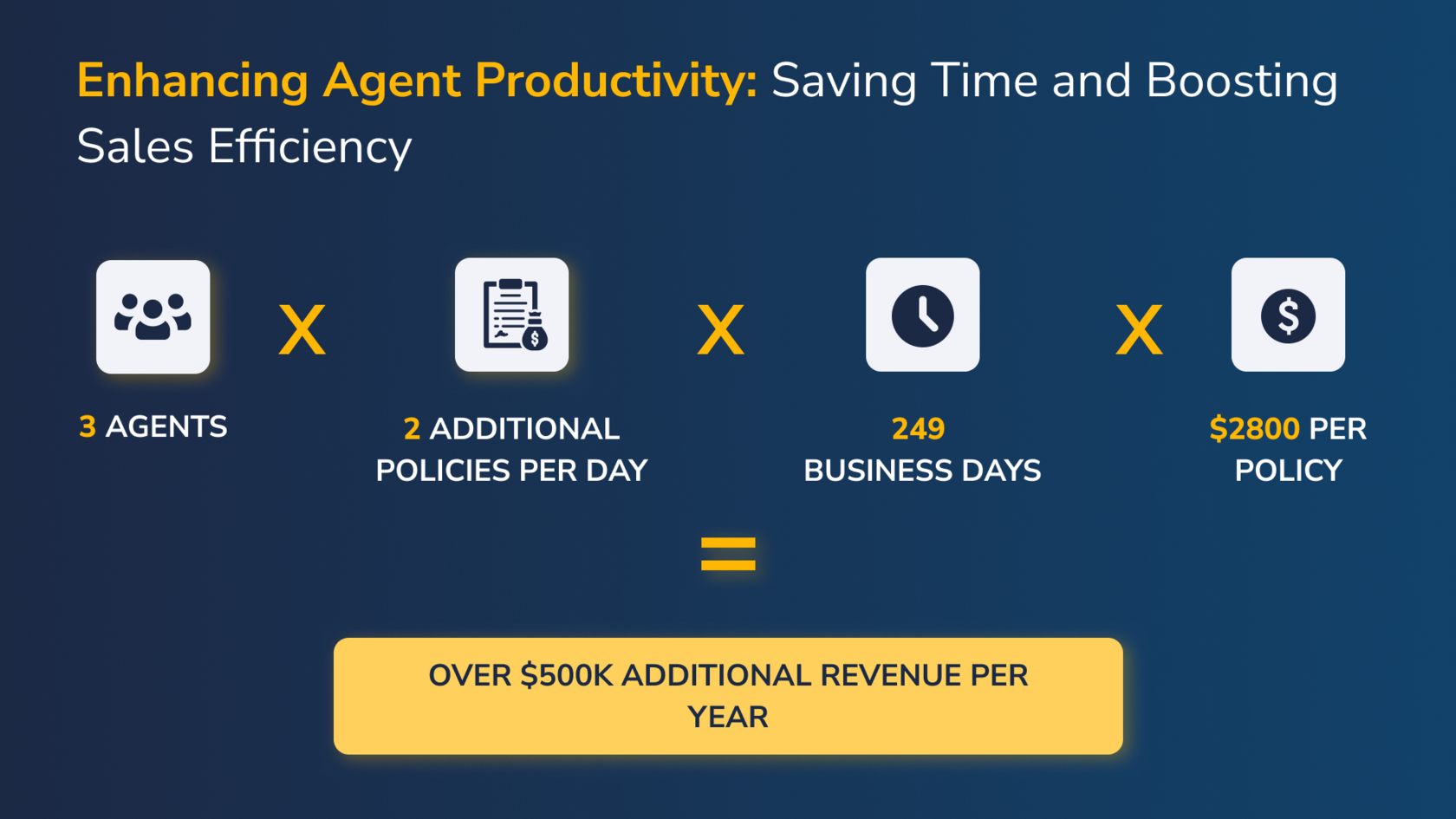

Consider this scenario:

- Productivity Increase: Each of your three agents can save 2 hours a day on administrative tasks and use this time to focus on renewals and new business.

- Additional Policies: Each agent could handle 2 more policies per day

- Business Days: There are 249 business days in a year.

- Average Policy Value: The average policy value is $2800.

Revenue Impact:

- Calculation: 3 agents * 2 additional policies per day * 249 business days * $2800 per policy

- Result: This results in over $4 million in additional revenue per year.

By reallocating just a small portion of their time, your agents could significantly increase the agency’s productivity and revenue.

Too Long to read? Here's a Quick Infographic

Common Challenges Affecting Agent Productivity

1. Administrative Overload:

Servicing New Business/Renewals:

Time Consuming Documentation.

- Excessive time spent on servicing policies, handling paperwork, and managing renewals reduces availability for sales.

- Example: One agency found agents spent 30% of their time on administrative tasks, affecting productivity and motivation.

- Data Point: 57% of insurance professionals spend more than half their day on administrative tasks rather than sales (Vertafore Survey).

Time Consuming Documentation.

- The need for detailed documentation for compliance and record-keeping purposes adds to the administrative burden.

- Example: An agent mentioned spending several hours each week on compliance documentation, detracting from client-facing activities.

2. Quoting Process:

Manual Quoting:

Inconsistent Quoting Systems:

- Time-consuming and prone to errors due to manually pulling quotes from multiple carriers.

- Example: An agent reported spending hours each week gathering and comparing quotes, cutting into selling time.

- Data Point: Automating the quoting process can increase productivity by up to 40% (Bain & Company Study).

Inconsistent Quoting Systems:

- Different carriers use different quoting systems, creating inconsistencies and confusion.

- Example: Agents often have to re-enter client information multiple times across various platforms, leading to data entry errors and wasted time.

3. Staff Management Issues:

High Turnover and Long Onboarding:

- High turnover rates and long onboarding periods disrupt productivity.

- Example: An agency reported it took 6-12 months for new employees to become fully productive.

- Departure of high-performing producers often leads to significant drops in team productivity and morale.

4. AMS Issues:

Inadequate Agency Management Systems:

- Inefficient AMS leads to disorganized operations, causing agents to waste time searching for information and managing data manually.

- Example: One agency found their AMS too expensive and not user-friendly, leading to a chaotic my workflow.

5. AI and Technology Adoption:

Lack of Advanced Tools:

- Slow adoption of AI and advanced technology tools limits the automation of repetitive tasks.

- Example: Agents reported spending hours each day on data entry and basic customer service tasks that could be easily automated with the right technology.

Solutions to Increase Agent Productivity

1. Implement Outsourcing Solutions:

- Outsourcing Administrative Tasks

- Partner with specialized firms to handle administrative tasks like data entry, document processing, and customer service.

- Example: Outsourcing routine tasks to virtual assistants or third-party service providers can free up significant amounts of time for agents.

Benefit: Ensures tasks are handled by experts, improving accuracy and efficiency.

2. Adopt AI In Your Operations:

Streamline Operations with AI:

Benefits:

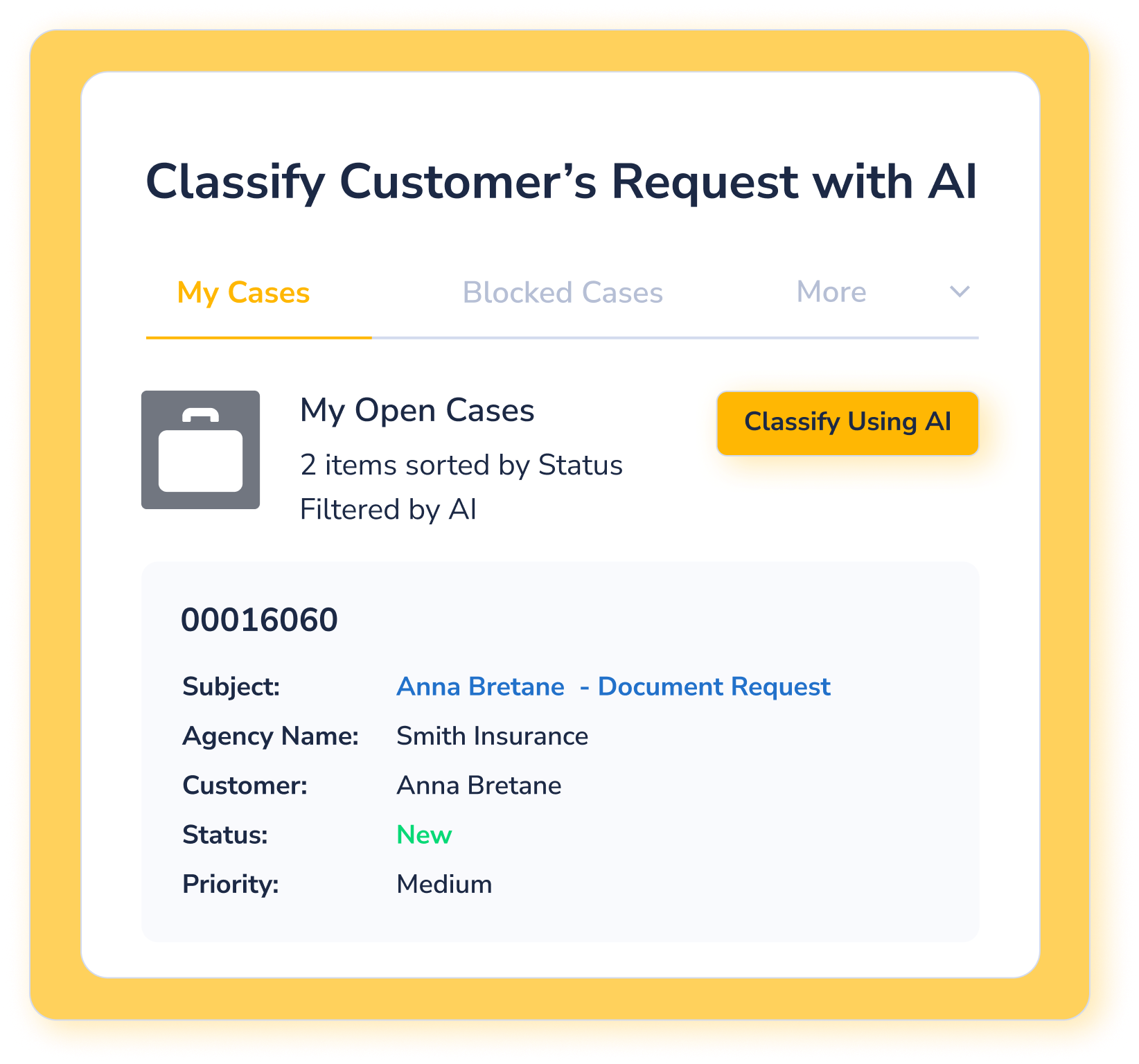

Next steps for cases

- Integrate AI into your AMS to automate and streamline backend operations.

- AI can classify customer requests, prioritize tasks, and generate summaries and next steps for cases.

- Example: AI categorizing incoming emails and routing them to the appropriate department significantly reduces time spent sorting through inboxes.

Benefits:

- AI can analyze and route cases to appropriate queues (sales, service, commercial).

- AI-generated summaries and next steps enhance efficiency.

Next steps for cases

- Sales related cases New policy inquiries, quote requests, or follow-up on potential leads.

- Service related cases Existing customer support issues, policy changes, or renewal requests.

- Commercial related cases: Specific inquiries or issues related to commercial insurance policies, such as business coverage or claims.

- AI can analyze these cases based on their content and route them to the appropriate department or queue, ensuring they are handled by the most suitable team and reducing time spent on sorting emails.

When an agent needs to review an email and create a ticket, it can be a time-consuming task. Now, imagine a scenario where everything is prepped and ready for you to simply take action. This streamlined process could boost productivity by up to 30%.

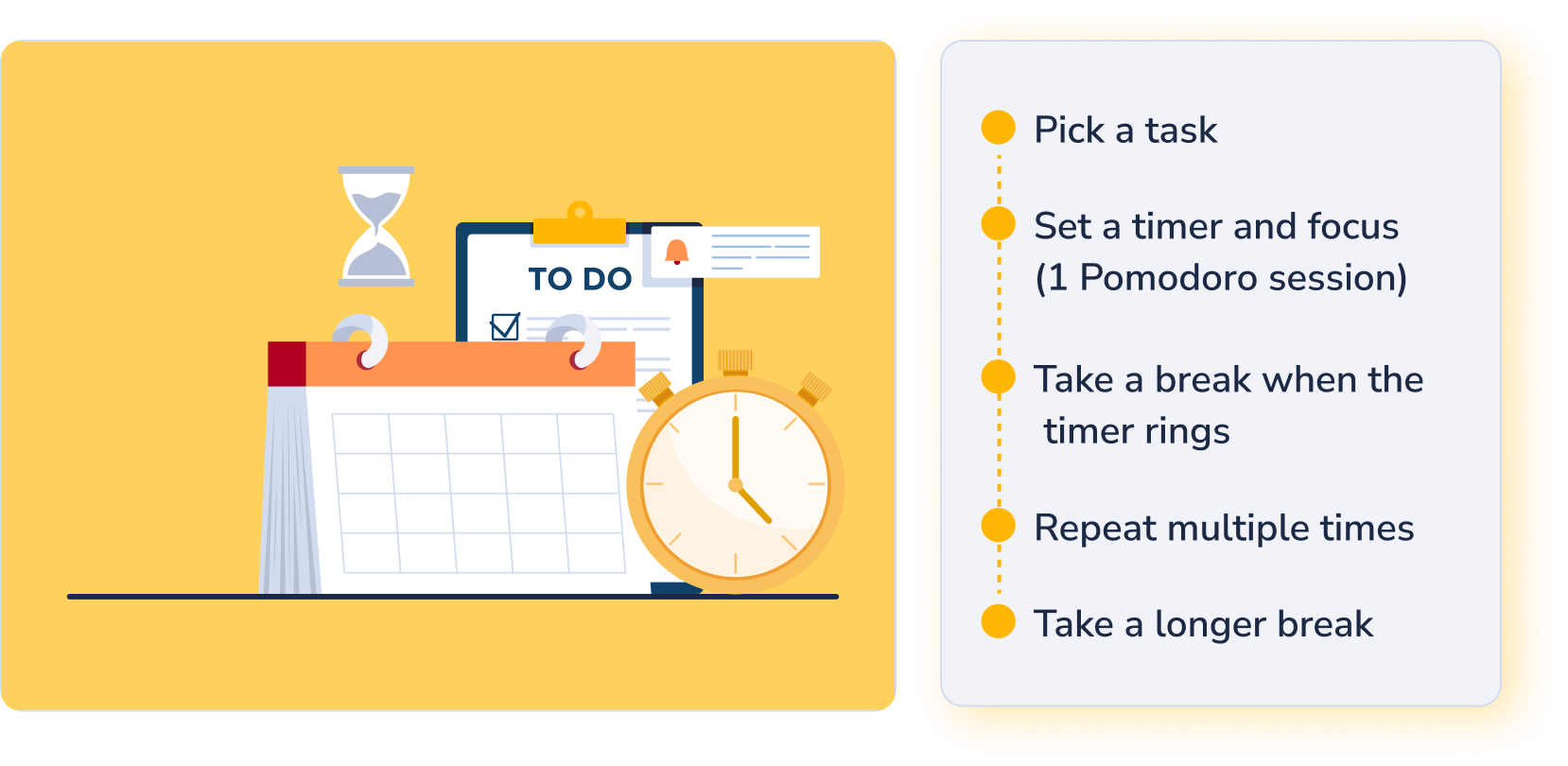

3. Leverage Time Management Tools:

Time Management Techniques:

Benefits:

- Encourage agents to use techniques like the Eisenhower Matrix or Pomodoro Technique to prioritize tasks effectively. Utilize time-tracking tools to identify and reduce time-consuming activities, optimizing schedules and resource allocation.

- Example: Using a time-tracking tool revealed agents spent disproportionate time on low-priority tasks. Reallocating these tasks helped agents focus on higher-value activities.

Benefits:

- The Eisenhower Matrix helps categorize tasks by urgency and importance, focusing on high- impact activities.

- The Pomodoro Technique maintains focus and productivity by breaking work into intervals with short breaks.

4. Streamline Administrative Processes:

Automation and Digitalization:

- Implement electronic document management systems and digital signatures to minimize paperwork.

- Automate workflows to reduce time spent on administrative tasks, allowing agents to focus on revenue-generating activities.

- Utilize collaboration tools and cloud-based platforms for seamless communication and information sharing.

- Example: Automating document signing and storage processes can significantly reduce time spent on handling physical paperwork and improve document retrieval times.

5. Enhance Client Communication:

Automated CRM Systems:

Here’s a quick rundown of some of the popular CRMs you can go with:

Salesforce

Extensive features and integrations

Scalable for businesses of all size

Steep learning curve

HubSpot

Free basic CRM features

Strong marketing and sales tools

Advanced features can be costly

Zoho CRM

Comprehensive feature set

Good customer support

Some features are less intuitive

Pipedrive

Focused on sales pipeline management

Affordable

Basic reporting capabilities

- Use Customer Relationship Management (CRM) systems to automate client follow-ups and personalized communications. Automate email campaigns for policy updates, coverage changes, and client milestones, ensuring timely and consistent communication.

- Example: Automating birthday and renewal reminders can ensure consistent client engagement without manual effort.

- CRM systems track client interactions and preferences, helping agents tailor communication and improve relationships.

Here’s a quick rundown of some of the popular CRMs you can go with:

Salesforce

- Pros

Extensive features and integrations

Scalable for businesses of all size

- Cons

Steep learning curve

HubSpot

- Pros

Free basic CRM features

Strong marketing and sales tools

- Cons

Advanced features can be costly

Zoho CRM

- Pros

Comprehensive feature set

Good customer support

- Cons

Some features are less intuitive

Pipedrive

- Pros

Focused on sales pipeline management

Affordable

- Cons

Basic reporting capabilities

6. Improve Quoting and Proposal Processes:

Quoting Engines:

Benefits:

- Invest in a robust insurance quoting engine to pull quotes from multiple carriers simultaneously. Enable clients to compare plans and enroll online, improving their experience and freeing up agents' time.

- Example: An agency implemented a quoting engine that reduced quote generation time from hours to minutes, allowing agents to handle more clients efficiently.

Benefits:

- Automated quoting tools ensure clients receive accurate and up-to-date information, enhancing trust in the agency.

7. Optimize Staff Management:

Streamlined Onboarding and Training:

Benefits:

- Develop a streamlined onboarding process to reduce the time it takes for new employees to become productive. Implement regular training and development programs to ensure staff are well-equipped to handle their responsibilities efficiently.

- Example: Creating a structured training program helped new hires reach full productivity faster, reducing the overall impact of turnover.

Benefits:

- Regular training sessions keep staff updated on industry changes and best practices, ensuring they remain efficient and knowledgeable.

- While each of these solutions can gain some level of efficiency and productivity gain but the level of impact when implemented together is substantial

New Model Insurance Outsourcing Powered by AI

Combining technology, people, and processes into a cohesive model can significantly enhance agent productivity. By partnering with a solution provider that offers a balanced mix of AI-driven tools and professional outsourcing services, insurance agencies can:

By adopting these strategies, insurance agency owners can create an environment where their agents thrive, ultimately leading to increased productivity and profitability for the agency.

- Achieve higher productivity and sales performance.

- Reduce the administrative burden on agents, allowing them to focus on client relationships.

- Streamline operations and improve overall efficiency with advanced technology and automated workflows.

- Ensure consistent and high-quality service delivery through a well-trained and managed support team.

By adopting these strategies, insurance agency owners can create an environment where their agents thrive, ultimately leading to increased productivity and profitability for the agency.