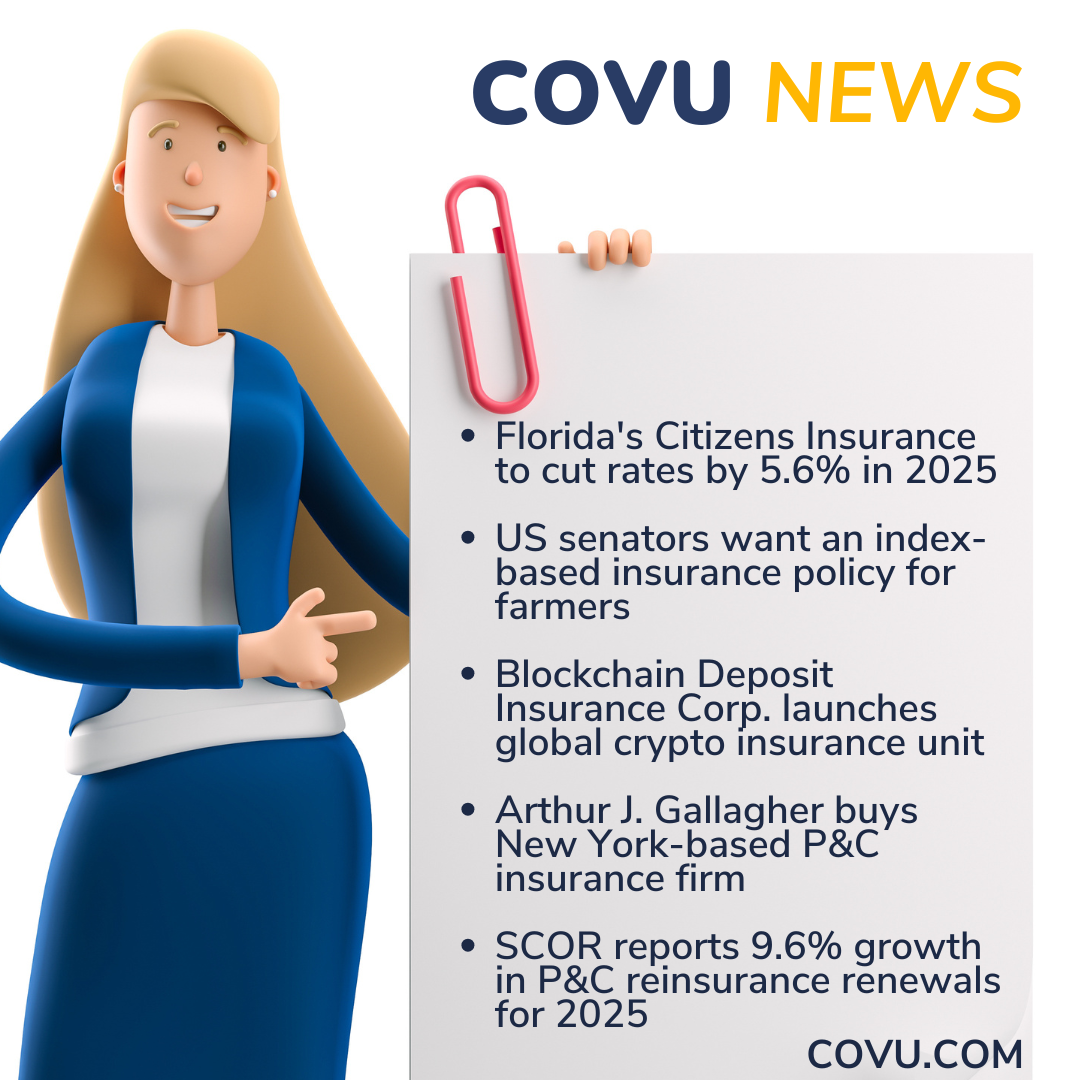

In this week's news will talk about how Arthur J. Gallagher buys New York-based P&C insurance firm, Blockchain Deposit Insurance Corp. launches global crypto insurance unit, and much more…

Florida's Citizens Insurance to cut rates by 5.6% in 2025

Florida’s Citizens Property Insurance Corp. will reduce rates by an average of 5.6% statewide in 2025, according to Gov. Ron DeSantis.

The governor said the state had the lowest average increase in homeowners insurance rates nationwide over the past year.

The reduction follows Citizens’ previous request for a 13.5% average rate increase across personal and commercial lines, which the company argued would still fall short of actuarially sound rates or make its policies noncompetitive with the private market.

In August, Citizens said that rates would need to increase by 92.8% to meet the state-mandated requirement of remaining noncompetitive with private insurers.

The governor said the state had the lowest average increase in homeowners insurance rates nationwide over the past year.

The reduction follows Citizens’ previous request for a 13.5% average rate increase across personal and commercial lines, which the company argued would still fall short of actuarially sound rates or make its policies noncompetitive with the private market.

In August, Citizens said that rates would need to increase by 92.8% to meet the state-mandated requirement of remaining noncompetitive with private insurers.

US senators want an index-based insurance policy for farmers

A group of US senators is urging the Federal Crop Insurance Corp. to develop an index-based insurance policy, also known as parametric insurance, to address risks farmers face from extreme weather, according to a report from AM Best.

The Withstanding Extreme Agricultural Threats by Harvesting Economic Resilience (WEATHER) Act proposes a multi-peril index insurance product that would link agricultural income losses to data from the National Oceanic and Atmospheric Administration, satellites, climate models and other sources, according to a statement from Sen. Chris Van Hollen, a Democrat from Maryland.

A fact sheet from the office of Sen. Peter Welch, a Vermont Democrat, states that the bill directs the US Department of Agriculture to use its research and development authority to explore parametric insurance options.

The proposed policy would base insurance coverage on a farm’s income rather than crop prices, which Welch said would better reflect losses associated with crop damage. Parametric policies would also streamline claims processes by automatically triggering payments when a weather event meets predefined criteria.

The Withstanding Extreme Agricultural Threats by Harvesting Economic Resilience (WEATHER) Act proposes a multi-peril index insurance product that would link agricultural income losses to data from the National Oceanic and Atmospheric Administration, satellites, climate models and other sources, according to a statement from Sen. Chris Van Hollen, a Democrat from Maryland.

A fact sheet from the office of Sen. Peter Welch, a Vermont Democrat, states that the bill directs the US Department of Agriculture to use its research and development authority to explore parametric insurance options.

The proposed policy would base insurance coverage on a farm’s income rather than crop prices, which Welch said would better reflect losses associated with crop damage. Parametric policies would also streamline claims processes by automatically triggering payments when a weather event meets predefined criteria.

Blockchain Deposit Insurance Corp. launches global crypto insurance unit

Blockchain Deposit Insurance Consultant Group LLC has announced the launch of an international cryptocurrency insurance unit under the name Blockchain Deposit Insurance Corp. (BDIC).

The newly formed entity will provide digital wallet insurance for select cryptocurrencies and establish its headquarters in Bermuda, with affiliate offices in Switzerland, Hong Kong/Greater China, Canada, and South America.

BDIC plans to apply for Lloyd’s coverholder status in the coming months, which would enable it to develop insurance policies in collaboration with Lloyd’s syndicate members.

The company said that achieving this status would support the creation of a structured insurance framework for the cryptocurrency sector.

The newly formed entity will provide digital wallet insurance for select cryptocurrencies and establish its headquarters in Bermuda, with affiliate offices in Switzerland, Hong Kong/Greater China, Canada, and South America.

BDIC plans to apply for Lloyd’s coverholder status in the coming months, which would enable it to develop insurance policies in collaboration with Lloyd’s syndicate members.

The company said that achieving this status would support the creation of a structured insurance framework for the cryptocurrency sector.

Arthur J. Gallagher buys New York-based P&C insurance firm

Arthur J. Gallagher & Co. announced the acquisition of Dominick Falcone Agency and Falcone Associates Inc.

The financial terms of the transaction were not disclosed.

Based in Syracuse, New York, Dominick Falcone Agency provides property and casualty insurance products to commercial and personal lines clients, primarily in central New York. Its affiliate, Falcone Associates, offers employee benefits services.

Following the acquisition, Michael Lavalle, David MacLachlan, Renee Guariglia, Chris Marshall and their team will continue operating from their current location. They will report to Brendan Gallagher, who oversees Gallagher’s Northeast region retail property and casualty brokerage operations, and Scott Sherman, who leads the company’s Northeast region employee benefits consulting and brokerage operations.

The financial terms of the transaction were not disclosed.

Based in Syracuse, New York, Dominick Falcone Agency provides property and casualty insurance products to commercial and personal lines clients, primarily in central New York. Its affiliate, Falcone Associates, offers employee benefits services.

Following the acquisition, Michael Lavalle, David MacLachlan, Renee Guariglia, Chris Marshall and their team will continue operating from their current location. They will report to Brendan Gallagher, who oversees Gallagher’s Northeast region retail property and casualty brokerage operations, and Scott Sherman, who leads the company’s Northeast region employee benefits consulting and brokerage operations.

SCOR reports 9.6% growth in P&C reinsurance renewals for 2025

SCOR has announced its January 2025 property and casualty (P&C) reinsurance renewal results, reporting a 9.6% increase in estimated gross premium income (EGPI).

The company maintained its underwriting discipline while expanding its presence in preferred business lines as part of its Forward 2026 growth strategy.

Reinsurance demand remained strong, though market conditions were slightly more competitive due to increased capital supply. SCOR kept terms and conditions largely stable and maintained net profitability in its P&C reinsurance portfolio.

SCOR renewed approximately 64% of its P&C reinsurance premiums during the January 2025 renewal period, accounting for about half of its total P&C portfolio. The renewed book reached €5.27 billion, an increase from the previous year.

The company maintained its underwriting discipline while expanding its presence in preferred business lines as part of its Forward 2026 growth strategy.

Reinsurance demand remained strong, though market conditions were slightly more competitive due to increased capital supply. SCOR kept terms and conditions largely stable and maintained net profitability in its P&C reinsurance portfolio.

SCOR renewed approximately 64% of its P&C reinsurance premiums during the January 2025 renewal period, accounting for about half of its total P&C portfolio. The renewed book reached €5.27 billion, an increase from the previous year.